Financial wellbeing is a hugely important topic about the relationship between money and how it contributes to our happiness. CTP and Chris Budd, author of The Financial Wellbeing book, have built on their collaborative report on Financial Wellbeing, to launch the Financial Wellbeing Pulse. In his guest blog for CTP, Chris explains how the tool works and how people and organisations can get the most out of it.

Good with Money

‘Are you good with money?’ This question people commonly ask each other is a difficult one to answer. What does ‘good with money’ actually mean?

One person could answer ‘yes’ because they have accumulated great wealth – but may regret the sacrifice they made by not spending more time with their family. Another might reply ‘no’ because they are struggling to hold on to what they earn – yet they gain a lot from spending their money on their friends and loved ones.

How do we assess whether we are ‘good’ with money? One way would be to consider whether your relationship with money is adding to your long-term wellbeing.

MONEY AND HAPPINESS

This leads us to key questions around whether money makes us happier, and whether money creates barriers to our long term wellbeing.

The answer comes in two parts.

There are many studies into the sources of wellbeing. They tell us that the quality of our social relationships and having a sense of purpose in our lives are both key to longterm wellbeing. If we use our money to achieve these, then we could surely say we have a good relationship with money.

For example, one study found that people who were offered payment to donate blood were less likely to turn up on the day than those who were not offered payment. The incentive to give blood is to help others, not to get paid, and offering money made the act feel less purposeful.

Then there are the things that get in the way. Some human behaviours often developed over lifetimes to keep us safe, such as fear of losing something, might not lead to great financial decisions.

There are also self-limiting beliefs about money which can result in poor financial outcomes. It’s not uncommon to hear a person say, ‘I’m not good with money’, or ‘The stock market isn’t for me’. These aren’t truths, they are beliefs. Another example is, ‘I don’t deserve to have money’ – or ‘I do deserve to have money’.

Know Thyself

The second part is what is true of each of us. If wellbeing comes from having purpose, what do each of us have in our lives that brings us that purpose?

Some people have certain behaviour biases in greater measure than others. Others may have had an experience with money that has given them particular beliefs which cause them to make poor financial decisions.

This is a process I call know thyself. Insight into an issue helps us to make better decisions – and the starting point is to gain understanding of our individual relationship with money.

Just as CTP’s wider work challenges the idea that societal wellbeing is delivered merely by growing the nation’s wealth (in the form of GDP), this is also true at the individual level. How do we move the focus away from merely accumulating more money, to what that money is for? Measuring and understanding its wider impact is an important starting point for us all.

Using the Pulse

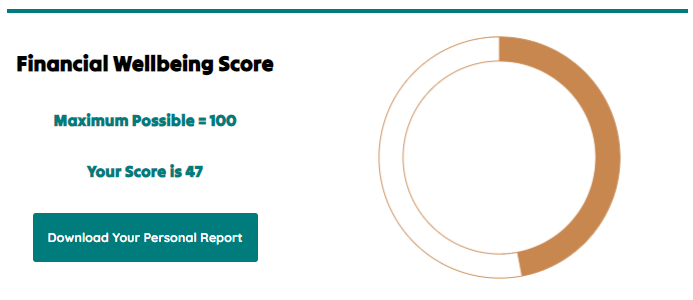

The Financial Wellbeing Pulse builds on CTP’s longstanding Happiness Pulse. It adds a series of important questions, designed through our earlier collaborative research process, around how we value and manage money, to provide an answer to the question of whether we are ‘good’ with money. It provides insight as to where a person’s relationship with money is adding to or reducing their wellbeing.

A key outcome of being able to measure something is that you can then track progress. When it comes to money, the standard measurements and general discourse tends to focus on very simplistic numbers – how much money you have, or the performance of your investment portfolio. The Pulse allows a person to track the extent to which their relationship with money is supporting their wellbeing.

By launching the Financial Wellbeing Pulse tool, we aim to help people across the UK to develop a healthier relationship with their money and use it to improve their lives. The tool is also designed to help accelerate the growing movement within financial planning and advice services, towards supporting the growth of wellbeing not just wealth.

The tool is available to individual independent financial advisors and financial advice companies, to track their impact on the financial wellbeing of their clients – bringing greater meaning to their work, and greater benefits to us all.

Chris Budd, author and founder of the Institute for Financial Wellbeing

Photo by Mathieu Stern on Unsplash

Read more about the Financial Wellbeing Pulse or get in touch to find out how we can help to shift your organisation, community or region to a Wellbeing Economy approach.

Comments are closed.